by William P-W, Year 11

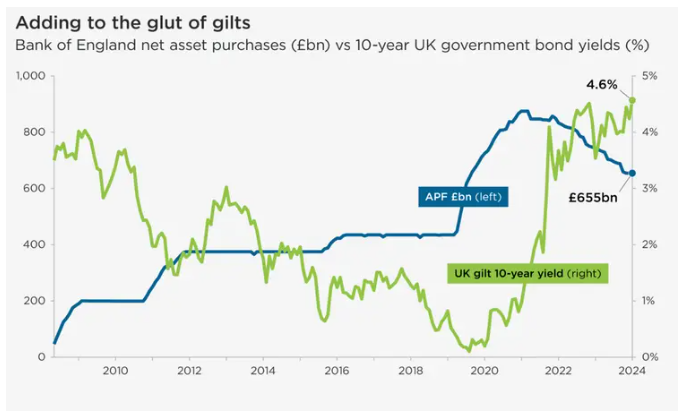

Firstly, I would like to talk about quantitative easing. First started by the Bank of England in 2009, following the global financial crisis which shook the UK economy- whose aftermath was characterised by rock bottom interest rates of 0.5% and sluggish growth - its aim was to stimulate the UK economy. This is due to the vast amounts of government bonds which were being bought up by the Bank of England through electronically created money, which reached a peak value of £895 billion in 2021 (for this amount, you could buy every house in Scotland!). This huge buy up of government bonds aimed to do a few things:

- Lower borrowing costs for the government by increasing the price of the bonds due to high demand, therefore reducing the rate of interest paid by the government to bondholders.

- Stimulate spending for households and businesses, due to the decreased borrowing costs, encouraging them to take out low interest loans to boost economic growth

- Increase asset prices. By removing bonds from the market, as the Bank of England is buying them up, investors are encouraged to buy up other, potentially riskier assets, increasing those asset prices. We could suggest this is one of the reasons for the very high asset prices at the moment, such as housing.

Overall, despite quantitative easing having a vast number of positive effects on the UK economy, such as stimulating growth, there were also some downsides. These include potential inflation, increased asset prices relative to the average salary, and widening inequality, which is one of the reasons for the rise of Reform UK.

However, since 2022 the Bank of England has been doing quantitative tightening, the opposite to quantitative easing. This is to reduce its government bond holdings, by allowing them to mature naturally. Quantitative tightening also aims to:

- Reduce inflation by limit the amount of money circulating in the economy which has become a very important reason due to the UK’s chronically high inflation, the highest in the G7 (2022-23)

- Reduce asset prices, which could decrease inequality

- Letting bonds mature naturally to create space for the bank of England to enact other monetary policies in the future

However, Quantitative tightening also comes with some downsides. This includes reduced liquidity, which makes it harder for banks to fund their operations. Furthermore, as the Bank of England sells off bonds, the prices of those bonds decrease, therefore increasing the interest rate which the government pays on it. This can be seen in the graph; however, it just so happened that when the Bank of England enacted quantitative tightening, Liz Truss' mini budget sent the bond market interest rates soaring, so we cannot fully correlate quantitative tightening to soaring interest rates on bonds.

This affects government policy as a higher proportion of government spending is used on debt interest repayments. This means the government either has to cut government spending, or increase taxation to avoid borrowing even more money. This often leads to the party becoming unpopular, and disillusioned in the eyes of voters. However, due to the fact that quantitative tightening reduces inflation, the bank of England may be able to reduce interest rates, therefore leading to increased economic growth, leading to more tax revenue for the government.

In conclusion, despite the pros and cons of quantitative tightening, there is a clear correlation to government policy, for the better or for the worse. This leaves us with the question, what is the right thing to do?